- +91 8275566989

-

In the financial world, risk management is the process of identification, analysis, and acceptance or mitigation of uncertainty in investment decisions. Essentially, risk management occurs when an investor or fund manager analyzes and attempts to quantify the potential for losses in an investment, such as a moral hazard, and then takes the appropriate action (or inaction) given the fund's investment objectives and risk tolerance.

Risk is inseparable from return. Every investment involves some degree of risk, which is considered close to zero in the case of a U.S. T-bill or very high for something such as emerging-market equities or real estate in highly inflationary markets. Risk is quantifiable both in absolute and in relative terms. A solid understanding of risk in its different forms can help investors to better understand the opportunities, trade-offs, and costs involved with different investment approaches.

.jpg)

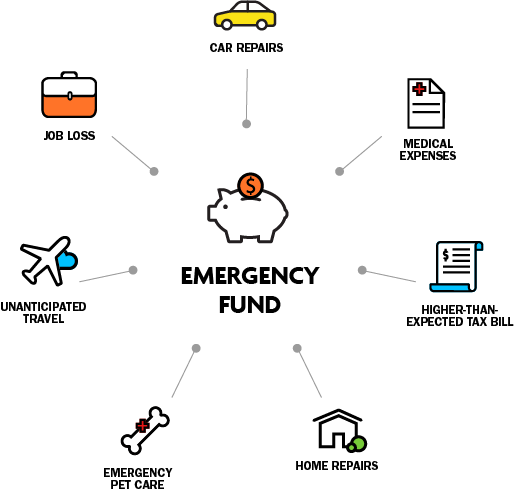

An emergency fund is a readily available source of assets to help people navigate financial dilemmas, such as the loss of a job, a debilitating illness, a major repair to home or car—not to mention the kind of major national crisis the coronavirus pandemic has created. The purpose of the fund is to improve financial security by creating a safety net of cash or other highly liquid assets that can be used to meet emergency expenses. It also reduces the need to either draw from high-interest debt options—such as credit cards or unsecured loans—or undermine your future security by tapping retirement funds.

An emergency fund should contain enough money to cover between three and six months’ worth of expenses, according to most financial planners. Note that financial institutions do not carry accounts labeled as emergency funds. Rather, the onus falls on an individual to set up this type of account and earmark it as capital reserved for personal financial crises.

704, Ganesh Nakshatram , D.S.K. Vishwa Road , Dhayari , Sinhgad Road ,

Pune – 411041.

+91 8275566989